Oilprice.com – Jan. 25, 2021

DUC inventory in the Permian subsides as oil prices increase.

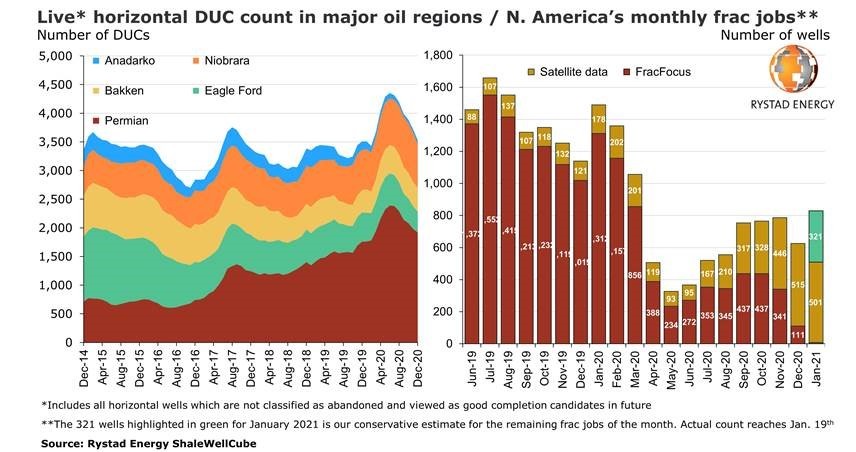

The number of drilled but uncompleted wells (DUCs) that accumulated at the height of the pandemic has started to subside to pre-Covid-19 levels after swelling to a multi-year high of 6,548 wells in June 2020. Currently the number of DUCs in the country has slimmed down to around 5,700 wells by the end of December 2020.

The reduction of inventory signals to a rise in frac activity and well completions by the end of 2021. The unusual inventory build-up as a result a sudden drop in demand driven by the pandemic along with the gradual depletion of producing wells in the second half of the year drove the DUC inventory to historical highs. The Permian Basin accounted for around 55% of the total horizontal ‘live’ oil DUC inventory as of December 2020, at around 1,900, but it accounted for a comparable share of the drawdown through the second half of the year, as the basin’s ‘live’ DUCs peaked at 2,400 wells in June 2020.

With the current environment of capital discipline and focus on free cash flow, the industry will largely stick with its original fracking programs in the first half of the year, but an upside in frac activity in the second half of the year could be sustained assuming that WTI holds above the $50 per barrel mark.

For more information refer to the article on OilPrice.com – 25-Jan-2021.